-Contributions can be claimed if youre Pag-IBIG Overseas Program Member at the end of five 5 ten 10 fifteen 15 or twenty 20 depending on what you chose during your registration. Get the Pag Ibig Retirement Form you need.

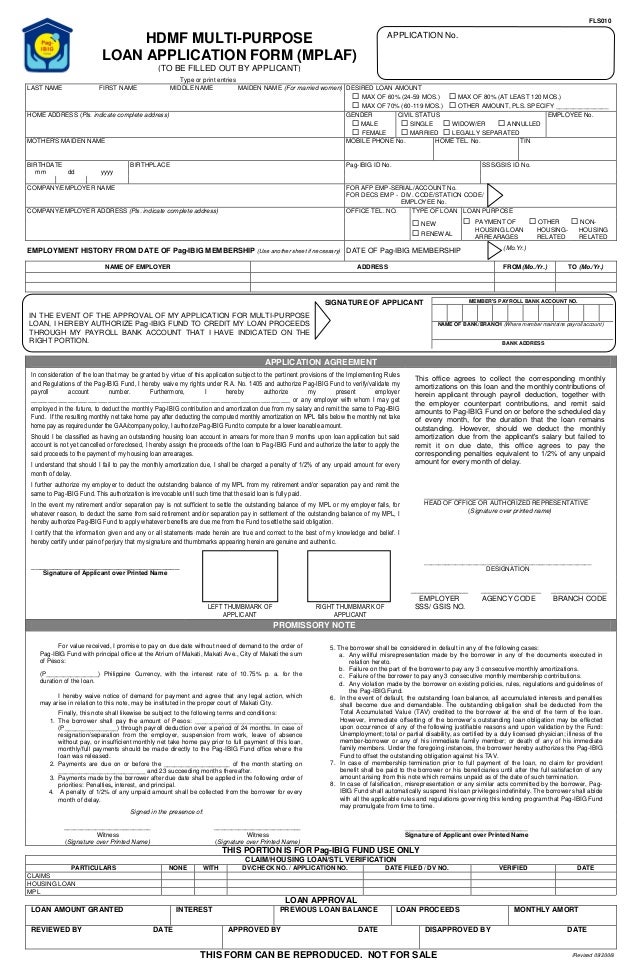

Pag Ibig Hdmf Application Form Aug 09 092809

7742 as well as members who voluntarily joined the Fund under EO.

Pag ibig retirement form 2019. SPECIFIC REQUIREMENTS FOR RETIREES NSO birth certificate SSS or GSIS Retirement Voucher or two valid IDs with photo signature and birthdate. Open it up with online editor and start altering. Optional Withdrawal of Pag-IBIG Savings - allowed for members who registered under RA.

Information Philippines Photocopy of Pag-ibig Loyalty Card and photocopy of one valid ID. Follow the step-by-step instructions below to e-sign your pag ibig form. 274 commonly known as the Revised Guidelines on PAGIBIG Fund Membership PAGIBIG Contribution Table 2018 PAGIBIG Monthly Compensation Monthly Compensation shall refer to.

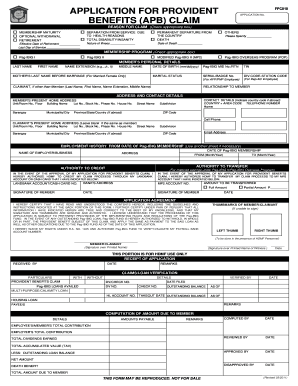

This means if your monthly salary is Php 5000 or higher your contribution is computed as follows. Modified Pag-IBIG II Program MP2 Housing Loan. Application for Provident Benefits APB Claim Form You can download this form from this Pag-ibig Funds Google Docs page.

Requirements for Claiming Your Pag-ibig Retirement Benefits. Complete the empty areas. Permanent Total Disability or Insanity.

US Legal Forms lets you quickly make legally-compliant documents according to pre-constructed web-based templates. Get the free pag ibig retirement claim online application form. Sample computation for a worker with at least Php 5000 monthly basic salary.

Use the Cross or Check marks in the top. When you reach 65 years old youll be under compulsory retirement and thus eligible to claim your Pag-IBIG contributions. If Pag-IBIG Loyalty Card is not available two 2 valid IDs present original and submit photocopy.

There are three variants. Provident Benefits Claim Checklist of Requirements. Php 5000 x 002 Php 100.

Application for Provident Benefits APB Claim Form HQP-PFF-285 CHECKLIST OF REQUIREMENTS. As long as you reach 65 years of age also known as the compulsory retirement you may opt to claim your contributions from PAG-IBIG. I hereby waive my rights under RA.

Retirement-Must be 60 to 65 years old-However a member can also retire as early as 45 years old but should do actual retirement from the GSIS SSS or a separate employer providentretirement plan. Retirement a member shall be compulsorily retired under the Fund upon reaching age 65. Prepare your docs in minutes using our simple step-by-step guide.

Create your e-signature and click Ok. APPLICATION FOR PROVIDENT BENEFITS APB CLAIM REASON FOR CLAIM Check appropriate box MEMBERSHIP MATURITY OPTIONAL WITHDRAWAL RETIREMENT Effective Date of Retirement Last Day of Service FPC010 APPLICATION. Partial withdrawal of savings may be made after 10 or 15 years of continuous membership from January 1995.

Employers Virtual Pag-IBIG Enrollment. For retirement purposes the valid IDs must reflect the members date of birth. The updated 2019 PAGIBIG Contribution Table will be based on the latest HDMF Circular No.

This service allows members with assigned Pag-IBIG Membership ID MID or Registration Tracking No RTN to accomplish and submit their Housing Loan Application online. Involved parties names addresses and numbers etc. Ang alam kong merong one-year window period for claiming ay yong partial withdrawal dapat sa 10th or sa 15th year lang.

In the event of any outstanding Pag-IBIG loan Pag-IBIG Fund is hereby authorized to withhold in whole or in part the provident benefit subject of this claim and apply the same as payment to the said loan as well as other obligations due to the Pag-IBIG Fund as of the date of this application. The UP Diliman Human Resource Development Office UPD HRDO advises management on human resource policy and administration including the proper interpretation of Civil Service Law and Rules. Quick steps to complete and e-sign Pag Ibig Retirement Form online.

Select the document you want to sign and click Upload. A typed drawn or uploaded signature. You need to submit the following documents to make a claim.

If you plan to retire early take note that you need to be at least 45 years old to make retirement Pag-IBIG claims. Start completing the fillable fields and carefully type in required information. Or from our page.

Use Get Form or simply click on the template preview to open it in the editor. Developers Online Housing Loan Application. The maximum monthly salary used for Pag-IBIG contribution computation is Php 5000.

You may retire earlier at age 60 from the SSS GSIS or government service or under your private employers retirement plan as long as youre at least 45 years old. In case you retire early say 60 years old then you can also claim for your contributions as long as you are at least 45 years old. About retirement ito ang rule na nakalagay sa likod ng claim form at sa Pag-ibig law.

Decide on what kind of e-signature to create. 49 rows Employers Data Form EDF HQP-PFF-002.

Authorization Letter To Pag Ibig Financial Technology Finance Money Management

Tidak ada komentar