Im an OFW and meron akong MP2. These are the many advantages when you begin MP2 as source of passive income.

Pag Ibig Mp2 Vs Sss Peso Fund Which Savings Program Is Better

Join us in this special webinar by our Mindanao Business Associate JP Billones as he takes on Pag-IBIGs MP2 program and the main things you should know h.

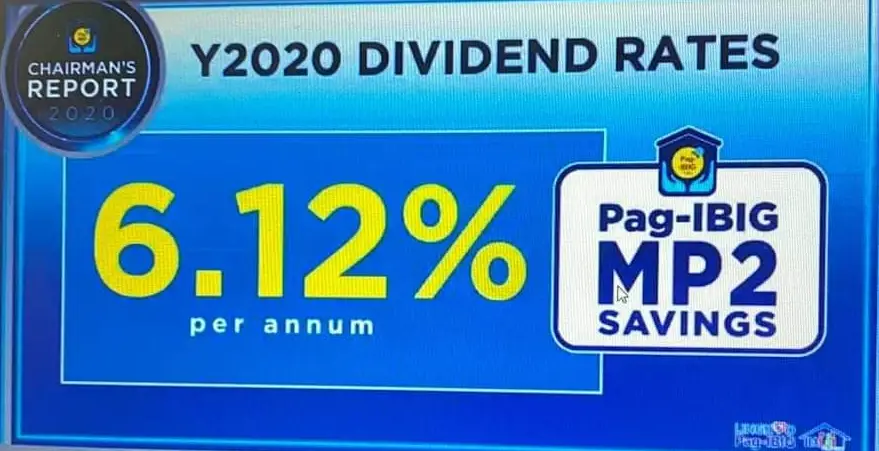

Pag ibig mp2 program review. Last year the MP2 Dividend Rate was 811 - its highest ever. MP2 dividends are derived from no less than 70 of Pag-IBIG Funds annual net income. Your MP2 savings earn tax-free dividends at a rate higher than the dividend rate of the Pag-IBIG Fund Regular Savings Program.

Your savings are very accessible too you can decide for its 5-year maturity. With Pag-IBIG MP2 you can grow money as much as you want to. For reference the average MP2 dividend rate in the past three years 2016-2018 is at 765.

The Pag-IBIG Funds Modified Pag-IBIG2 MP2 savings program which seeks placements maintained for a five-year period offers a more competitive dividend rate than most offered by banks and even corporate bonds. Unknown to most though that mandatory monthly contribution to your Pag-IBIG account isnt the only savings plan offered by the government-run savings and mortgage fund. With the Pag-IBIG Funds great financial performance every year MP2 investors can rest easy knowing that their funds are being managed well.

For reference the average MP2 dividend rate in. So what is Pag-IBIG MP2. The dividends you shall earn are tax-free.

The Pag-IBIG MP2 is a good investment for most medium and long-term financial goals. Its your decision if you want to withdraw or keep on depositing your income. Pag-IBIG MP2 is a voluntary savings program that allows Pag-IBIG members to contribute and get their money back in 5 years with dividends higher than the regular Pag-IBIG program.

MP2 dividends are derived from no less than 70 of Pag-IBIG Funds annual net income. The government-backed savings scheme isnt like any typical savings accountits a low-risk yet high-return investment. Our 3-year average MP2 Dividend Rate is at 696.

PAG-IBIG MODIFIED PAG-IBIG 2 MP2 Reply 18 on. Your MP2 Savings shall earn dividends at a higher rate than that of the regular Pag-IBIG Savings Program. While the SSS PESO Fund is more designed for people seeking a low-risk investment for their retirement fund.

It is guaranteed savings backed up by the government so its ideal for conservative investors who want to have a safe place to invest and without capital loss. The Pag-IBIG MP2 savings program is worth considering. Your dividends are derived from no less than 70 of the Pag-IBIG Funds annual net income.

Its also easier to start saving with the MP2 because it doesnt have a lot of conditions for enrollment. This means you can keep your money in a safe investment vehicle within a reasonably long period with earnings higher than regular bank savings accounts and time deposits. Over the last 5 years the average dividend rate for Pag-IBIG MP2 is 710 while the average dividend rate for Pag-IBIG.

MP2 doesnt require you to save for a long time. Your savings is invested by Pag-IBIG and will earn through dividends just like investing in mutual funds. Compared to the regular savings program which is mandatory to all Pag-IBIG members the Pag-IBIG MP2 savings program has a higher dividend rate.

It comes as no surprise that savings from Pag-IBIG members keep on increasing 4 every year. Pag-IBIG MP2 offers more flexibility in terms of payment channels. The Modified Pag-IBIG II MP2 Program is an additional and voluntary five 5 year savings facility being offered by HDMF to its Pag-IBIG I members that will provide them with a yield higher than their Pag-IBIG I membership.

This is unlike the regular Pag-IBIG savings program or other investment portfolios that have more than 20 years of maturity. The HMDF invests the funds collected from the Pag-IBIG MP2 mostly in its housing loan program as well as its short-term loan programs. I pay online via PayPilipinas.

Benefits of Pag-ibig MP2. Furthermore do consider which among the two programs would be more convenient for you to open and manage. February 14 2018 062058 pm.

HOW TO EARN 80000 PESOS FROM PAG IBIG MP2Hi everyoneHeres part 3 on our series on why you should invest in Pag-Ibigs MP2In this video I will show you a. Modified Pag-IBIG II MP2 Program The MP2 program is a voluntary program and solely a saving scheme designed to provide active Pag-IBIG 1 members with another savings option. What is Modified Pag-IBIG II MP2 Program Heres a definition of term straight from Pag-IBIG.

For reference the average MP2 dividend rate in. Unlike the regular Pag-IBIG program that every employed and self-employed Filipinos are part of the MP2 is a voluntary program that provides a higher earning potential than a regular savings account. Your MP2 savings earn tax-free dividends at a rate higher than the dividend rate of the Pag-IBIG Fund Regular Savings Program.

Pag-ibig MP2 Program has a yield higher than those given under the Pag-IBIG 1 membership program because of the higher dividend rate. I asked Pag-Ibig to send me my contribution statement to make sure na natatanggap yung contributions ko sa MP2 dahil nga sa 3rd party ako nagbabayad. Your MP2 savings earn tax-free dividends at a rate higher than the dividend rate of the Pag-IBIG Fund Regular Savings Program.

The Modified Pag-IBIG II or MP2 is an optional savings scheme for members who want to save more and earn higher dividends on top of their regular Pag-IBIG savings. MP2 dividends are derived from no less than 70 of Pag-IBIG Funds annual net income. Funds grow through interest payments from borrowers.

How To Invest In Pag Ibig Mp2 In 2021 Complete Guide

Tidak ada komentar