Permanent departure from the country. On Year 6 you can withdraw the second MP2 savings and so on You can also do yearly or one-time savings.

How To Withdraw Pag Ibig Mp2 Savings Serve Pinoy

A Pag-IBIG member becomes qualified to withdraw once any of the following occurs.

Pag ibig mp2 savings withdrawal. In other words dont expect to get high rewards when investing in Pag-IBIG MP2. Your total savings would be 150000 and at the end of the fifth year your first Pag-IBIG MP2 account would mature and give you 36266. Puwede ma-withdraw ang MP2 before five years with the following circumstances.

Savings can only be withdrawn before maturity period under these circumstances. Permanent departure from the country. A member who opts for compounding of MP2 Dividends and later decides to pre-terminate hisher MP2 Savings for reasons other than the circumstances stated.

But youll be paid only half of the total dividend earned if you chose to receive dividends after five years or only your contributions if you chose the annual dividend payout option. Upon full withdrawal of your MP2 Savings after its 5-year maturity period with your MP2 Dividends compounded annually. Total disability or insanity.

Through annual pay-out with your MP2 Dividends credited to your savings or checking account enrolled in any of Pag-IBIG Fund accredited banks such as the Land Bank of the Philippines LBP Development Bank of the Philippines DBP or other banks that the Pag-IBIG Fund. Separation from service by reason of health. You can also opt to continue for another 5 years.

Sa Pag-IBIG Savings I naman ito ang mga allowed events for withdrawal. Total disability or insanity. You may withdraw your MP2 savings for a reason other than those allowed by Pag-IBIG.

Pagkatapos ng 20 years membership maturity at may at least 240. You may withdraw your Pag-IBIG Regular Savings should any of the following occur. If youre trying to build an emergency fund do so in a savings account.

Death of the member or any of hisher immediate family member. It is harder to resist the temptation if you have the means to withdraw money from your savings account. Membership maturity A member is eligible for a refund if he or she has already remitted at least 240 monthly membership contributions.

Pag-IBIG MP2 is perfect for people with a low-risk appetite. Through annual pay-out with your MP2 Dividends credited to your savings or checking account enrolled in any of Pag-IBIG Fund accredited banks such as the Land Bank of the Philippines LBP Development Bank of the Philippines DBP or other banks that the Pag-IBIG Fund. If the savings was not withdrawn after 5 years the dividend rate that will be applied is the same as in the Pag-IBIG I which is lower than the flexible dividend rate of MP2.

Also you can withdraw cash anytime through ATM withdrawal. Upon meeting certain conditions Pag-IBIG Fund members or their eligible beneficiaries can withdraw their contributions. Death Its not possible to check your pag ibig contribution online so remember to keep your receipt.

Pag-IBIG MP2 savings should not be considered an emergency fund. Natanggal sa trabaho dahil sa pagkakasakit separation from work by reason of health. After two years if no withdrawal is done they dont earn any gains anymore.

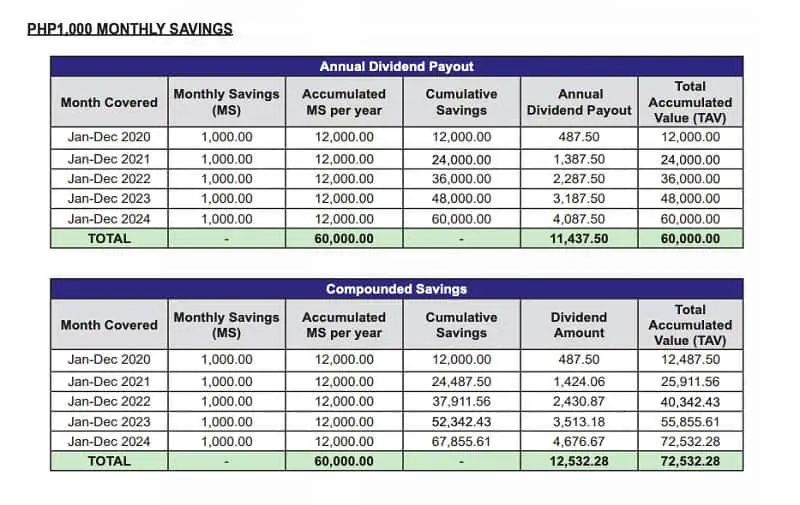

See below a sample estimate of your earnings and income starting Year 5 and so on if you save at least P500 monthly. Permanent and total disability or insanity. Membership maturity after 20 years equivalent to 240 monthly contributions.

You can also request for a copy at any Pag-IBIG. Upon full withdrawal of your MP2 Savings after its 5-year maturity period with your MP2 Dividends compounded annually. Yes a member may pre-terminate and withdraw hisher MP2 Savings.

Retirement at age 60 optional or 65 mandatory Separation from service due to health reasons. If you want to get the benefits of the two you may open both Pag-IBIG MP2 and a bank savings account. Maturity date is after 5 years wherein youll be able to withdraw your savings plus dividends.

To log-in key-in your issued Pag-IBIG MID No Last Name First Name and Date of Birth MMDDYYYY. The first thing to consider in withdrawing or claiming the regular savings from the Pag-IBIG Fund is to know whether you are eligible or not. Pre-termination or withdrawal of MP2 savings prior to maturity shall be allowed under any of the following circumstances as applicable.

Although banks offer relatively lower interest rates they offer the convenience of withdrawing your money anytime you need them. If you keep your savings with Pag-ibig beyond the lock-in period they will no longer earn the same dividend and instead will revert to the same earnings as the mandatory regular savings. You have the option of continuing the MP2 membership for another 5 years to let the savings compound or withdraw the total savings.

How To Enroll Invest In Pag Ibig Mp2 Savings Program An Ultimate Guide

Tidak ada komentar