If you are not connected with a single company that considers you on its monthly payrol. If you are in Cebu and planning to settle your life in this province you need to be mindful of the process of getting your own mandatory documents because one way or another you will be needing those once your employer requested for it.

Voluntary Contribution Guide For Pag Ibig Philhealth And Sss Members

SSS Sickness Benefit and Threatened Abortion.

Sss philhealth pag ibig benefits. SSS and PhilHealth are meant to provide you support when you get sick or old and can no longer work. For HDMF Pag-Ibig For a monthly basic salary of Php15000 then your HDMF Contributions is Php15000 X 02 Php300. Meanwhile Pag-IBIG helps you pay for your house.

SSS provides benefits that employees can enjoy such as Retirement benefits Disability benefits Maternity benefits and Sickness benefits. As such the basic purpose of these agencies is to allow people access to economic or social support from government so that they can attain or remain above the minimum standard of living. Same example with your monthly basic salary of Php15000 then your monthly contribution is Php225 by looking at the table.

Benefits for SAHMs and mom-preneurs Yes stay-at-home and self-employed moms can enjoy all the benefits of employees too. BUt you have to shoulder of the contributions yourself without the aid of a. PhilHealth - partial medical expense reimbursement discounted rates least benefit better have separate med insurance.

SSS Pag-IBIG PhilHealth SSS Benefits. SSS Contribution During Maternity Leave. Enforce SSS Philhealth Pag-Ibig Benefits Posted on February 10 2017 The Department of Labor and Employment has called on employers anew for the full provision of benefits to their workers by way of compulsory enrollment and remittance to the SSS Philhealth and Pagibig.

In case of death your heirs will claim your benefits. SSS - salary loan maternity disability sick death benefits pension upon retirement age optional savings scheme to have higher payout after many years. The higher you pay the more it will increase the cost of your Pag-IBIG benefits.

Pag-Ibig fund contribution for all filipino members. Sa computation mo ng tax 14500-100-175-526801368920 yan and basis ng computation ng tax plus other benefits. You can borrow up to a maximum of 80 percent of the TAV of the damaged property.

You could also apply for a calamity loan even if you already have an existing loan from Pag-IBIG. The services and benefits from SSS PhilHealth and Pag-IBIG are just part of the social safety net provided by the government. You can become a member of the Pag-IBIG Fund as a Voluntary contributor.

Business Math pt6 Salary Wages Benefits Tax SSS Pag-Ibig Philhealth Contributions Grade 11 Senior High School Module BusinessMath SHS Salary. I can only inform you how much your basic contribution is sa basic na 1450000 ER EE Total Contribution HDMFpag-ibig 10000 10000 20000 PHICphilhealth 17500 17500 35000 SSS 107820 52680 160500 ung mga totals un dapat ang lalabas na remitted sa account mo sa bawat isa. But a fixed part of your monthly budget can help you to not miss one.

This Outsourcing Alert is issued to inform all concerned on the updates on government mandated benefits from Philippine Health Insurance Corporation PhilHealth Pag-IBIG Fund and Social Security System SSS. Again it depends on your budget. PhilHealth to release Php 30 billion to hospitals amid fight against Covid-19.

PHP 200 is the minimum of your monthly contribution. Foncardas said that it was a privilege to have this kind of seminar to know the benefits and updates that the employee should avail and claim specially those who plan to retire at the age of 60. Permanent temporary or provisional employees hired by private companies under the age of 60 with a monthly income of.

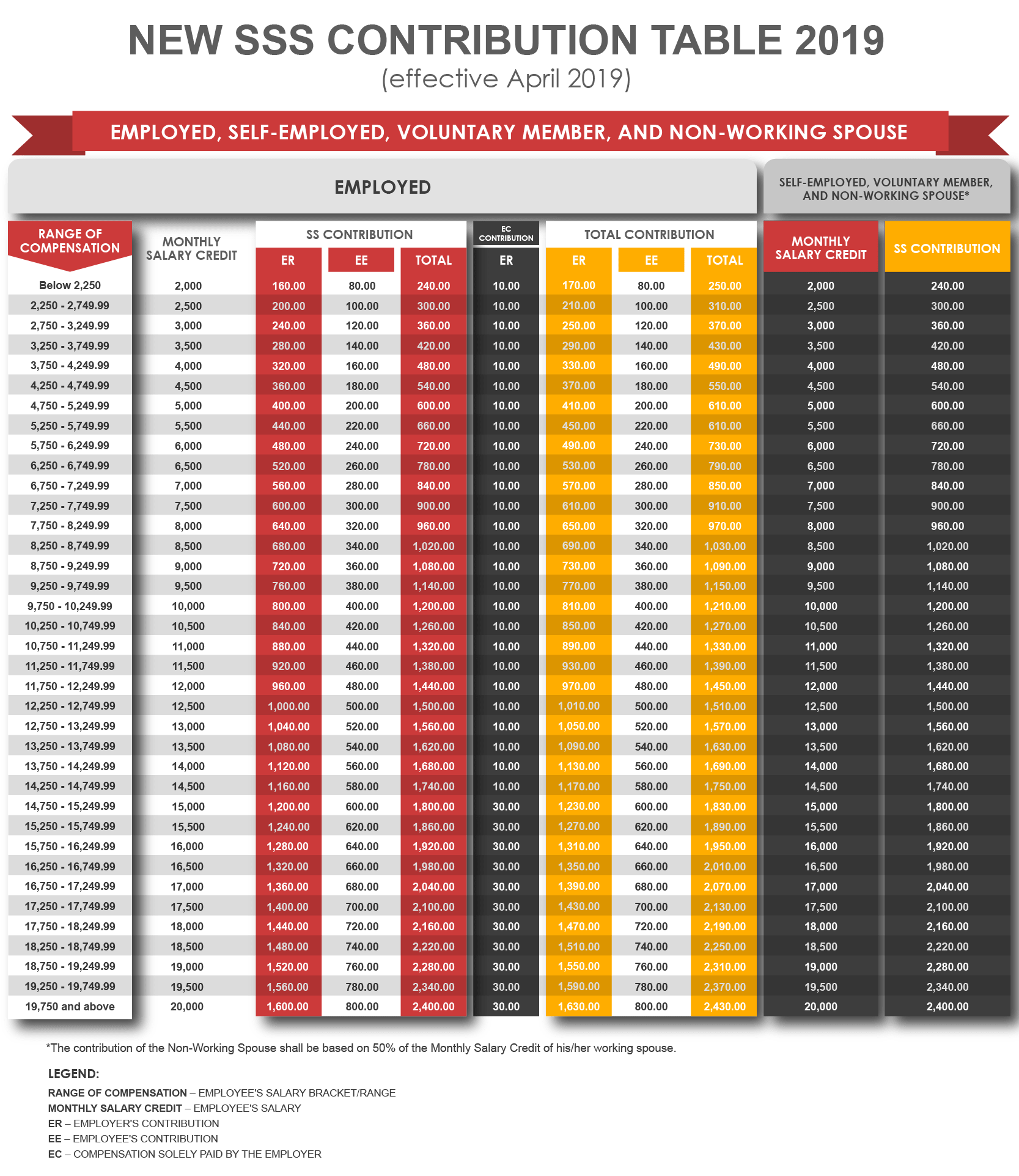

SSS Sickness Benefit and Magna Carta for Women. Your monthly SSS deduction is Php600. NEW PHILHEALTH CONTRIBUTION SCHEDULE.

The Home Development Mutual Fund HDMF or better known as the Pag-IBIG Fund is the national. You can claim your Pag-ibig retirement benefits if you are in one of these conditions. Applying for Pag-Ibig SSS and Philhealth is the number one responsibility of every Filipino before they start working.

The Social Security System or SSS is the governments all-around insurance program for private employees. You may want to read. The RCMB 5 conducted a one-day seminar on GSIS Pag-ibig Philhealth and SSS Benefits and Updates on 06 August 2019.

Your contributions to Pag-IBIG PhilHealth and SSS is dependent on your budget. Government-mandated benefits from the Pag-IBIG PhilHealth and SSS cover the following workers. PAG-IBIG - salary loan housing loan calamity loan.

60 years old or older retired under your companys plan permanently disabled immigrant or terminated from employment due to health.

Register New Employees With Sss Philhealth And Pag Ibig Fund

Tidak ada komentar